Prediction Markets and "Informed" Trading

The Market for Knowing Things

In stock markets, “knowing things” is sometimes illegal. If you work at Apple and trade on unannounced earnings, that’s insider trading.

But if you buy Apple shares because you noticed iPhone cases selling out at the mall, that’s fine. That’s public information, even if you’re the only one who paid attention.

The distinction is weird: see it in the wild, you’re a genius; hear it in a boardroom, you’re a felon.

Enter: prediction markets.

Prediction markets are where you go to bet on things you normally can’t bet on—like who’ll win the Nobel Peace Prize, or whether aliens exist, or if it will rain tomorrow.

Prediction markets operate almost entirely in that second, informed category. There are no CFOs, no confidential boardroom meetings. Just people looking for clues. And if you find one? You get rewarded for being the first to know things that are knowable but not yet known.

It’s finance’s purest form of gossip monetization.

The Nobel Market That Knew Too Much

In prediction markets, prices = probabilities. If María Machado’s Nobel Peace Prize odds are trading at 60 cents, the market thinks she has a 60% chance of winning.

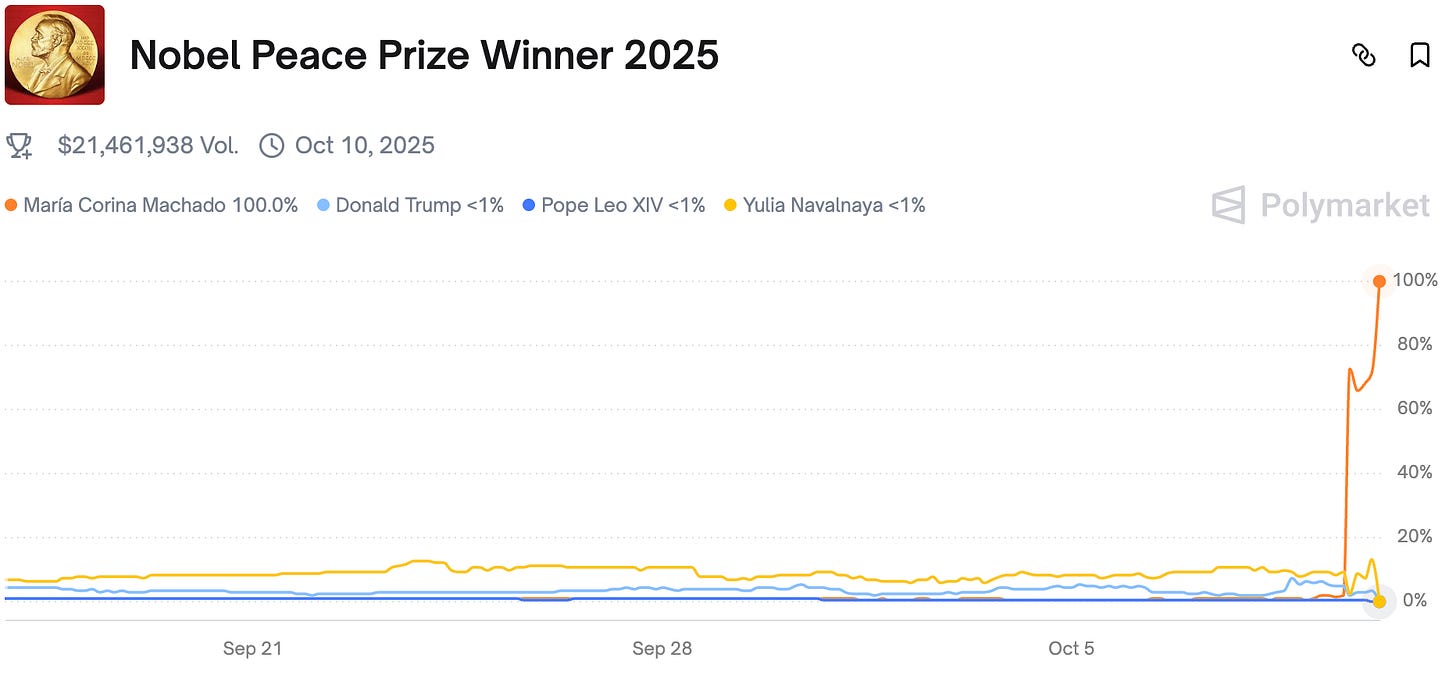

Last week, a few hours before the official Nobel Peace Prize announcement, a trader on Polymarket started buying shares of María Machado to win. The price spiked, fast.

The internet screamed inside job. Norway opened an investigation.

Naturally, people wondered: did the trader have inside information? Was there a leak?

Maybe? Or maybe a trader noticed something the rest of us didn’t.

The Nobel website runs on WordPress. Like most WordPress websites, it has a sitemap: a small text file that lists every page on the website. Sometimes, even ones not yet officially “live.”

Sometime before the announcement, a new entry appeared:

https://nobelprize.org/prizes/peace/2025/machado/facts/

It turns out: the official portrait of Machado (machado.jpg) was uploaded to the Nobel site at 07:18 GMT, more than an hour before the announcement. That someone noticed that and made a big bet.

It’s not exactly insider information; it’s…enthusiasm? That’s the fun part of prediction markets: you can profit by being a little bit better at knowing things before other people do.

Efficiency, Not Espionage

So no, an insider didn’t front-run the Nobel Committee. The system just rewarded someone for paying attention. That’s the point. They’re incentivized to.

In prediction markets, you can make money by being slightly more right, slightly earlier. It’s like the stock market, except instead of trading companies, you’re trading confidence. The underlying asset isn’t cash flow; it’s conviction, measured in cents.

This is an example of a marketplace working—dumbly and beautifully. Not in a grand, philosophical way. Just in the small, hilarious way where someone got rich because a webmaster hit “publish” too early.