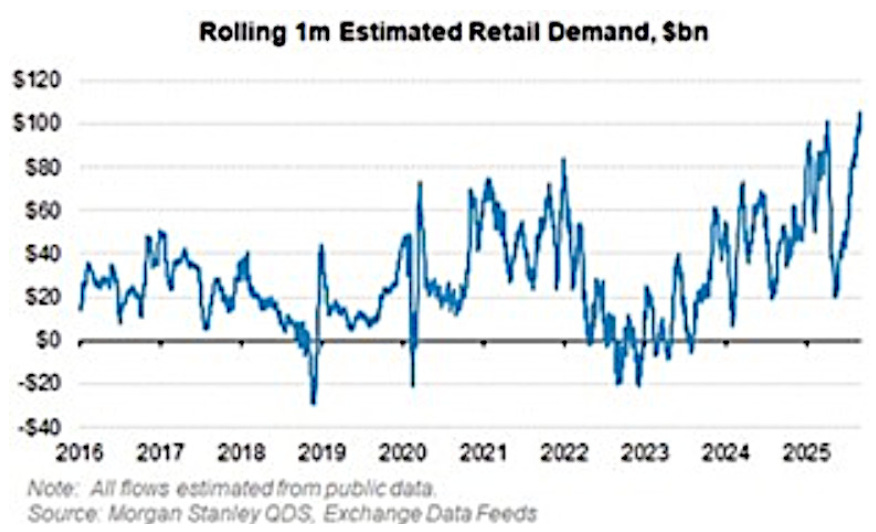

The $100 Billion Month

Everyone’s an investor now. Some just don’t know what they’ve invested in.

Retail investors just bought over $100 billion of US stocks in a single month—the largest on record. We’ve never seen anything close. Not in the meme-stock era, not during the pandemic stimulus checks, not even when GameStop briefly became everyone’s retirement plan.

It’s a generation deciding, all at once, that if they can’t afford real estate, they might as well buy the stock market.

Call it substitution, not mania. Young people are moving from granite countertops to call options. And honestly, it’s worked. The S&P is up 150% the last five years. Try getting that from your high-interest savings account.

There’s also a social shift happening. Investing used to be something your dad did through a financial advisor; now it’s part of your feed and your group chat. Markets are no longer financial ecosystems; they’re cultural ones.

But it also means the line between participation and speculation is thinning.

Why does this matter for regulators?

When $100 billion of fresh, mostly inexperienced capital floods into the market, the sharks start circling. Fraud loves enthusiasm. It thrives on the same dopamine that fuels bull runs.

Today’s retail investor is younger, self-directed, and learning from Reddit threads and YouTube channels. Regulations were built for a world where the problem was access. Now the problem is influence.

We need to think less about who’s giving advice, and more about how advice travels. We need to think of social platforms as financial intermediaries—not in a punitive way—but in recognition that’s where investors actually learn.

The traditional model assumes people read things. They don’t. We’re not reading prospectuses, we’re reading comment sections.

More money and less experience is a dangerous combination. Every increase in new retail participation brings with it a wave of opportunists: pump-and-dumps, AI trading bots, and Discord servers offering pre-IPO shares in imaginary companies.

A Reality Check

The $100 billion month is a turning point.

The role of regulations is not to stop people from investing when things are risky. It’s to ensure the guardrails are ready for a world where participation happens differently: faster, riskier, and more social than we ever planned for.

In the old system, investors needed protection from dirty brokers.

In this one, they need protection from belief.