The Stock Market, In Theory

Belief is our economic engine.

The stock market is a way to turn good ideas into money.

You start a business. Maybe you make car parts, or coffee, or microchips that teach computers how to think.

To grow, you sell little pieces of your business. Investors buy those pieces—shares—because they think your company will make money, and some of that money will eventually make its way back to them.

In theory, this is a wonderful little feedback loop. Investors give you cash, you use it to build factories and hire people, those people earn wages and spend them in the economy. Your stocks go up, and, well, everyone gets a little richer.

That’s the theory.

The S&P Shortcut

If you don’t want to pick individual stocks, you buy something that tracks them all: an index.

Buying an index is the same as saying: I think, generally, stocks will go up over time.

The most popular example is the S&P 500—a list of the 500 biggest public companies. Airlines, banks, soda, software, sneakers. A little bit of everything.

You can’t buy the S&P 500 itself—it’s just a list—but you can buy an index ETF like SPY or VOO that copies it.

These are supposed to represent the whole economy.

But they don’t.

How It Actually Works

The S&P is weighted by market cap, which means the bigger your company, the more of the index you represent.

If Apple’s stock doubles, it becomes twice as important to “the economy,” at least as far as the S&P 500 is concerned.

So when people say “the S&P 500 went up today,” what they really mean is “Apple and Microsoft went up.” The other 490 companies are decorations.

That, historically, hasn’t been a bad thing. But something recently changed.

You used to buy the S&P 500 and owned a diversified slice of 500 businesses.

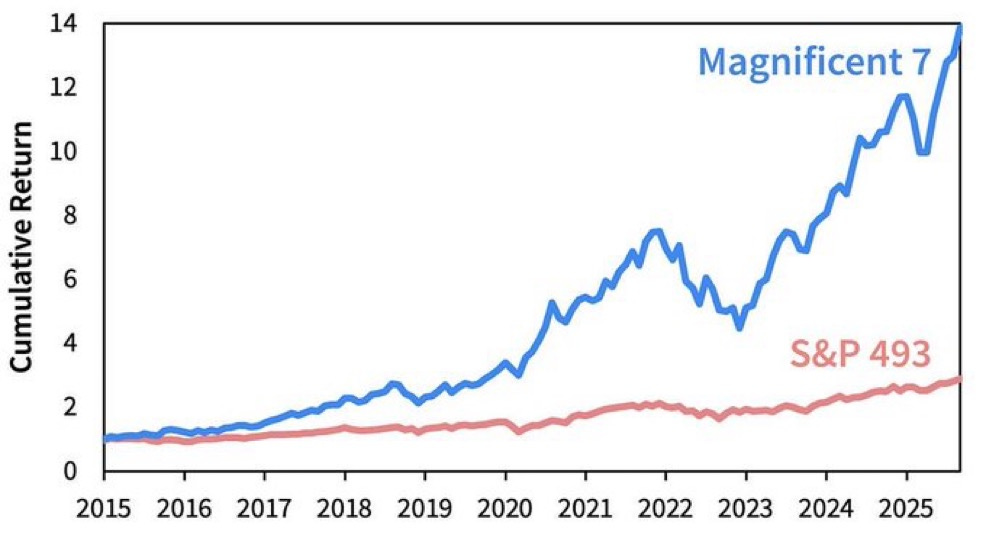

Now you buy it and mostly own Apple, Microsoft, Nvidia, Amazon, Google, and Meta.

In 1990, the ten largest companies made up 15% of the S&P 500. Today, they make up more than 40%.

It’s like calling your diet “diverse” because you rotate between three brands of protein bars.

The Narrative Loop

These companies are trading higher than ever for one reason: AI.

Arguably, the S&P 500 (our entire economy) relies on a single narrative: “AI changes everything.”

Nvidia builds the chips.

Microsoft sells the cloud.

Apple promises the hardware.

So the loop goes like this:

Tech stocks go up →

You feel richer →

You buy more stuff →

Tech stocks go up again.

But, when that AI story eventually cracks—and all stories do—it won’t just be AI stocks that fall. It will be the economy.

The economy now depends on a few companies, and those companies depend on a single story.

The risk isn’t that AI breaks; it’s that the story does.

Because once people stop believing, everything built on that belief has to come down too.