Young People Aren't Betting the House—You Already Took the House

Why waiting became the riskiest strategy.

There’s a very popular take right now that goes something like this:

Young people are reckless. They’re day-trading. They’re buying options. They’re gambling on crypto. They’re treating the stock market like a casino.

That take usually comes from people who grew up in a very different system.

In that system, wealth accumulation was slow, boring, and—crucially—predictable.

You worked.

You saved a little.

You bought a house and invested some money.

Your company maybe gave you a pension.

Your house appreciated while you slept.

Your retirement grew at the same pace as time itself.

Stock-market “investing” mostly meant owning mutual funds. Mutual funds meant not thinking very hard. If you were feeling adventurous, you bought a blue-chip company you recognized from a television commercial and checked the price twice a year.

That generation didn’t exactly participate in markets. They stood near them.

And it worked.

Not perfectly. Not brilliantly. But adequately.

Then We Changed the System

Quietly, things changed.

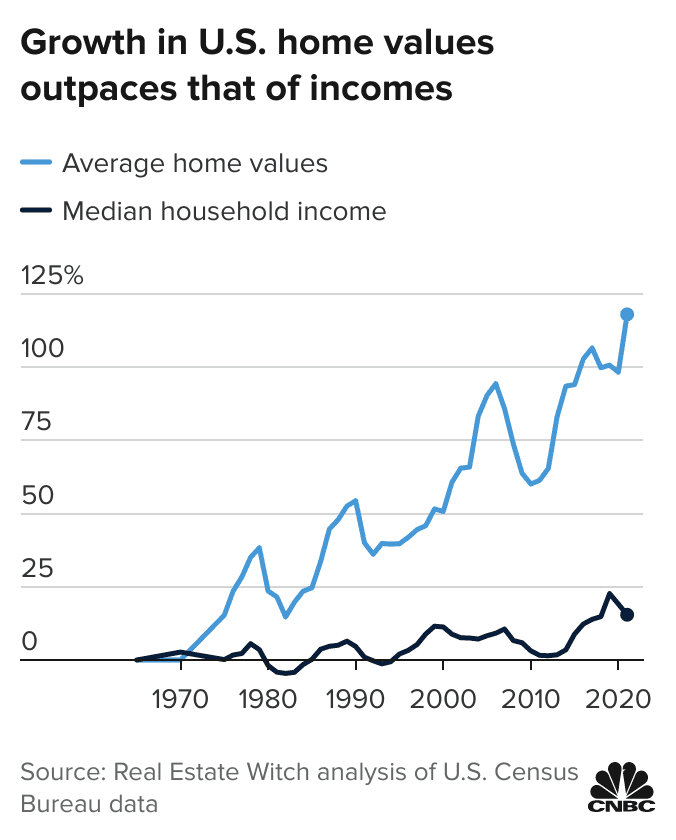

Wages decoupled from expenses. Housing became affordable only for those who already had houses. Savings accounts became something you used to avoid falling behind, not to get ahead.

At the same time, the culture of work changed.

Jobs used to move on tracks. You joined, you learned, you advanced. Loyalty meant something because time itself did some of the work. Tenure and pensions were everything.

Careers no longer move on tracks. They move in episodes. Projects replace paths. Tenure is no longer rewarded by default. In fact, staying at the same company for a lifetime is now viewed as risky.

Doing everything “right” no longer leads to gradual progress. It leads to treading water.

Everyone still knows the rules.

They just no longer lead where they used to.

The Timeline Problem

If you are 27, the problem isn’t a lack of discipline, it’s a lack of a viable timeline.

The “sensible” long-term plan—investing in 5% compounding dividend stocks—might buy you a condo at 55 if everything goes perfectly.

So, the question has shifted from “What is the optimal 40-year strategy?” to “Where do my decisions show up on a timeline I can actually see?”

In this new reality, waiting is the greatest risk:

Waiting for a promotion that may never come.

Waiting for savings to grow while prices sprint away.

Waiting for AI to potentially replace your role.

Immediate Feedback Beats Uncertain Promises

Young people are doing something that looks reckless if you’re still living in the old system: they’re participating.

They pour money into the markets.

They day trade.

They speculate.

They buy options.

Participation, it turns out, is highly motivating when other paths offer a “reward” that is no longer rewarding.

This is why young people aren’t “investing” in the passive, set-and-forget sense.

In markets, you make a decision, you take risk, and you get feedback. Quickly. Sometimes brutally. Even if the odds are bad. Even if the house has an edge. Even if most people lose.

But the feedback is real, and it is yours. You aren’t waiting for a middle manager to approve your promotion or hoping the housing market cools off before you’re 60.

Young people aren’t rejecting patience. They’re responding to a world where patience no longer guarantees progress.

Why This Isn’t Gambling

Social media will tell you young people are chasing Lambos. They’re not.

They’re chasing access.

To housing.

To time.

To something that feels like forward motion.

If you grew up in the old system, this behaviour looks irrational.

Why take high-risk bets?

Why risk losing money you “should” be investing responsibly?

If the reward for decades of discipline is maybe being comfortable at 65, it’s not hard to see why young people would rather take a small chance at changing their situation sooner.

From the outside, this looks speculative. From the inside, it’s about agency: choosing a chance of moving forward over the certainty of standing still.

Young people aren’t confused about the odds.

They’re confused about the point of waiting.